But in bill of Finance 2018, which Finance Committee of National Assembly will start debating Tuesday 10 October, famous "and at same time" presidential has lead in wing. With conversion of EWB into taxation on only real estate fortune and creation of a single levy of 30% on capital income, Mr. Macron feeds lawsuit already made him to be "president of wealthy".

The purpose of French taxation is to be redistributive and to reduce inequalities. This is obviously not case. The Treasury Directorate ensures that revaluation of social benefits, abolition of housing tax and reduction of sickness and unemployment contributions will more than offset increase in CSG and decrease of PLA by 5 euros. For 10% of less fortunate households, she calculated, " standard of living will increase by 2.9% by 2022", and by 2.1% if we take into account ecological taxation and tobacco, more than for average of French ( 1.7%).

Random "runoff"The French Observatory for Economic conditions (OFCE) makes anor point: 46% of gains in tax measures of quinquennium for households will benefit at top of scale, i.e. 10% who earn more than 3 600 euros net per month. The Treasury and OFCE do not share same assumptions, but y converge on fact that tax relief will benefit most favoured.

For example, of EUR 10.2 billion reduction in levies in 2018, reform of ISF and flat tax at 30% will cost 4.5 billion to state. At end of quinquennium, according to OFCE, richest 10% will earn 700 euros a year, when poorest 10% must be satisfied with a gain of less than 200 euros. If tax relief affects all households, with exception of well-off retirees – who will incur increase in CSG before taking advantage of decline in housing tax – imbalance is obvious. Tax justice is not on go.

READ ALSO: Who are winners and losers of tax policy of Emmanuel Macron?

To this unequal redistribution will be added cuts in public expenditure which would penalise first most deprived. Mr. Macron plays risk rar than annuity. He is convinced that by not securing financial investments to EWB, richest French will be saving on businesses.

The example of Sweden, often highlighted, shows that such "runoff" is random. In this country, disappearance of taxation of heritage, in 2007, did not have expected impact on growth. And since 2008-2009, re has been an increase in inequality. It is not surprising if this first budget of Macron era raises concerns within presidential majority. There is still time to correct shot. Parliamentarians to play ir part.

Service van collided with 2 trucks in Kocaeli: 30 injured

Service van collided with 2 trucks in Kocaeli: 30 injured Hospital fires, patients evacuated

Hospital fires, patients evacuated TR ü Fraudulent Hope

TR ü Fraudulent Hope The maximum number of campaigns is 1,000 TL

The maximum number of campaigns is 1,000 TL New era in the Waste Battery collection campaign in schools

New era in the Waste Battery collection campaign in schools Transfer at SSPC

Transfer at SSPC and the training materials of the lecture &quo;

and the training materials of the lecture &quo; Budget 2018: Tax Injustice

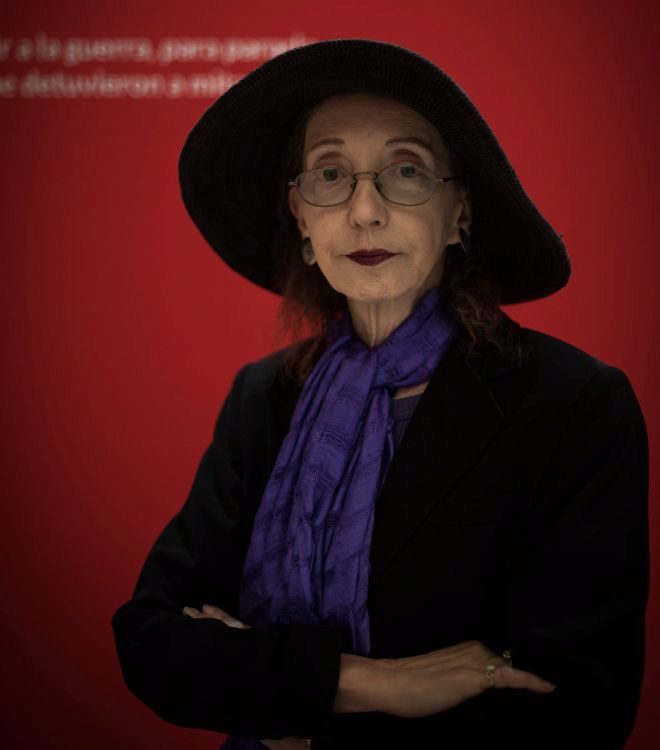

Budget 2018: Tax Injustice Joyce Carol Oates: "I like the corrosive humor"

Joyce Carol Oates: "I like the corrosive humor" The quarrels of history

The quarrels of history The average age of a heart attack is dropping!

The average age of a heart attack is dropping! Introduced Syrian children to chess

Introduced Syrian children to chess Number of fears in obesity surgery

Number of fears in obesity surgery Ezgi Mola and Enis Arıkan ' 10 11 12 '

Ezgi Mola and Enis Arıkan ' 10 11 12 ' 36. Countdown to Istanbul Book Fair

36. Countdown to Istanbul Book Fair Hurricane Nate: US states call for state of emergency

Hurricane Nate: US states call for state of emergency Zoido returns by surprise to Catalonia to support police and civil Guards

Zoido returns by surprise to Catalonia to support police and civil Guards 2018 FIFA World Cup European qualification results

2018 FIFA World Cup European qualification results Businessmen's special Note 8 is on sale

Businessmen's special Note 8 is on sale Are the iphones slowing down as a breeze?

Are the iphones slowing down as a breeze? 8th Battle of the Cepte

8th Battle of the Cepte iphones don't slow down

iphones don't slow down